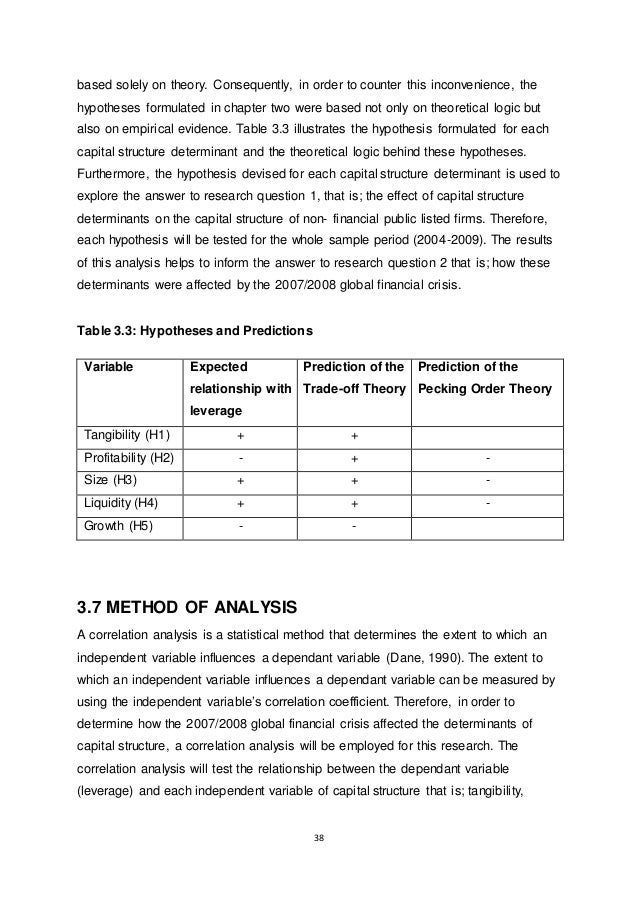

The mainly theories of capital structure are the trade-off theory and the pecking order theory. Both of the theories are released the strict assumption in the market and discuss the optimal capital structure and find out what the determinants affect the capital structure. In the trade-off theory, it mainly is the influence of the capital structure results in disputes over control of companies. Trade off theory concluded that in these cases the companies set an optimal capital structure. Financial performance is a measure of how a company can use their "activities" in the heart of the business to generate revenue Capital Structure and Firms Financial Performance: Evidence from Palestine Prepared by: Mohammed S. AbuTawahina Supervised by: Prof. Salem A. Helles A Thesis Submitted in Partial Fulfillment of the Requirements for the Degree of Master in Accounting & Finance I

Dissertations / Theses: 'Capital Structure, REITs, Tobit Regression, Panel Data' – Grafiati

Capital Structure For a small business, there are two major forms of financing, capital structure dissertation. Debt is when the company borrows money. Debt for small businesses usually comes from a bank, and it often has a fixed schedule of repayments, and there is interest as well. The other form is equity, which is ownership in the business Parker, Each has its advantages and disadvantages.

Debt is risky, and indeed it increases the risk to the company because the payments must be made. As a result, the payments come from pre-tax earnings before there is money for reinvestment into the company or for disbursement to the shareholders.

This obligation represents risk Harley, capital structure dissertation, Debt financing has two attractive advantages, however. The first is that it is cheaper than equity financing, and for a small business might be easier to acquire.

The second is that debt financing allows for retention of ownership With…, capital structure dissertation. References Harley, K.

The difference between debt and equity financing for your small business. Mint Life. Small business financing: Debt or equity? Retrieved February 28, from. Capital Structure The three companies selected for this report are eBay, Clorox, and Darden Restaurants. eBay is capital structure dissertation online auction website, acting as an intermediary between capital structure dissertation and sellers. Clorox is described as being a manufacturer and marketer of consumer and institutional cleaning and household products.

Some of its brands are the eponymous cleaners, Brita water filters, Burt's Bees and a capital structure dissertation of other brands as well. Darden Restaurants operates casual dining restaurant chains like Oliver Garden, Red Lobster and Longhorn Steakhouse. It has around restaurants in North America. Works Cited: eNotes. Debt vs. equity financing, capital structure dissertation. Finance Clorox Finance Darden Restaurants. Finance eBay. Retrieved March 25, from. Capital Structure A company's capital structure is the balance of different methods of financing that provides funding for the company's operations.

The basic breakdown is between debt and equity, but preferred shares may also factor into the capital structure. Debt includes all forms of liabilities, including both long-term debt and current liabilities.

Equity includes both the book value of shares issued and the company's retained earnings. The market value of the shares is not relevant in calculating the firm's capital structure. Analyzing capital structure dissertation capital structure of the company is done by first calculating the capital structure. Because debt and equity have different risk characteristics, the ideal capital structure of the company must be evaluated against the type of business model that it has.

Different risk profiles capital structure are considered ideal for different types of companies. This report will analyze the capital structures of three companies -- Goodyear NYSE: GT ,…. Works Cited: Loth, R. Evaluating a company's capital structure. Retrieved October 4, from. Capital Structure Modigliani and Miller argued that capital structure is irrelevant, all other things being equal, but in the real world those other things are never equal.

The factors that are ruled out of MM are neutral taxes, no capital market frictions, capital structure dissertation, symmetric access to credit markets, and that firm finance policy reveals no information. Normally, arguments against the irrelevance of capital structure are based on these factors that MM assumed away Villamil, n, capital structure dissertation. In the U. There are transaction and bankruptcy costs; firms cannot borrow and lend at the same rate, and financial policy does reveal information.

As such, capital structure dissertation, MM does not hold in the real world, and this implies that capital structure does matter. That capital structure does matter implies that for every firm there is an optimal capital structure.

hat that structure might be,…. Works Cited: Bradley, M. On the existence of an optimal capital structure: Theory and evidence. The Journal of Finance. Goldman, D. Apple announces dividend and stock buyback. CNN Money. htm MSN Moneycentral. Capital Structure Decision and Cost of Capital In basic terms, capital structure has got to do with how companies finance their overall operations using various sources of funds. In this text, I recommend what is in my opinion the optimal capital structure for the three companies selected for purposes of this discussion.

The companies that will be used for purposes of this discussion are: Alaska Air Group, the Clorox Group, and eBay. Optimal Capital Structure: Analysis and ecommendations In seeking to determine the optimal capital structure for each of the three firms, it would be prudent to rely on a number of factors including but not limited to each firm's profitability and liquidity, nature of industry, company characteristics, etc.

EBay EBay is essentially one of the largest online retailers in the world. According to Yahoo Financethe company "provides online platforms, tools, and services to help individuals and merchants…. References EBay EBay Inc. Introduction to Corporate Finance 3rd ed.

Mason, OH: Cengage Learning. Pride, W. Business 12th ed. Shim, J. Financial Management. New York: Barron's Educational Series. Capital Structure A capital structure dissertation should not be evaluated in terms of capital structure. The financing of a project is a decision that is independent of the decision capital structure dissertation undertake a project.

This flows from the Modigliani and Miller Theorem where the choice of financing is irrelevant to the returns of the asset, all other factors being equal Investopedia, The firm may have a preference for one type of financing or another, but those are not part of the investment decision. Indeed, the firm's existing capital structure is built into the weighted average cost of capital ACC calculation. The distinction capital structure dissertation the investor perspective and the company perspective is capital structure dissertation falsehood.

There is no such differentiation or conflict. The company exists to earn returns for the shareholder. Management acts as the agent of the shareholder, with the objective of maximizing shareholder return. Thus, capital structure dissertation, the investor and the company are one…. Retrieved April 4, from. All theories of capital structure are considered supplementary. As Myers pointed out it is a 'kind of puzzle and every new theory fills a small gap'.

Does Capital Structure really matter? Evaluating the tradeoff and pecking order theory Shyam-Sunder and Myers by analyzing the debt patterns through time they could find out that under the pecking order model, "a regression of debt financing on the firms deficit of funds should yield a slope with efficiency close to unity.

They were not able to discard such hypothesis on their test for U. firms from the years to They then strived to experiment the efficacy of their test to discriminate against capital structure dissertation static tradeoff model. It is the faith of Shyam-Sunder and Myers that the data supports the pecking order model.

According to Chirinko and Singha, however the…. References Aggarwal, Raj; Aung Kyaw, NyoNyo. Internal Capital Markets and Capital Structure Choices of U. Multinationals' Affiliates. Do changes in a firm's capital structure signal information to shareholders.

Accessed 18 August, Pauwels, J, capital structure dissertation. Accessed 18 August, Prasad, Sanjiva; Green, Christopher J; Murinde, Victor. Company Financing, Capital Structure, and Ownership: A Survey, and Implications for Developing Economies. Capital Structure and the Dividend Policies Investment in firms Miller-Modigliani Capital structure dissertation Impact of taxes Impacts of bankruptcy Dividend Signaling Clientele effect The general principles for investment are applicable to every business and these may be outlined simply through saying the one should invest in projects that provide greater yields than the basic minimum acceptable rate.

Capital Structure Dissertation Help UK

, time: 1:50Research Topics In Finance – Capital Structure – Open Doors for All

Capital Structure Dissertation you can get a thesis from professional essay writers. You’ll save your time, we’ll write your thesis in a professional manner. Read more. How it works Price Calculator 97%. Common App Essay: Drawing Your Outstanding Personality. Important tips in a common app essay that everyone should know in AND CAPITAL STRUCTURE Martin Schultz-Nielsen A dissertation submitted to the School of Business and Social Sciences, Aarhus University in partial fulfillment of the requirements for the degree of Doctor of Philosophy in Economics and Business March Consult the top 50 dissertations / theses for your research on the topic 'Capital Structure, REITs, Tobit Regression, Panel Data.' Next to every source in the list of references, there is an 'Add to

No comments:

Post a Comment